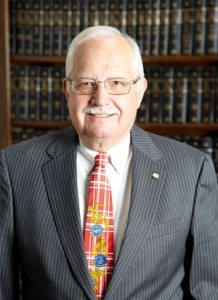

Walter Virden III, CFP®

Building a Better Financial Life.

A cornerstone of financial planning is the recognition that everyone’s economic and life situation is unique. Personalized service is essential when matching clients with the right financial products and services.

A commitment to professionalism and the cooperative development of unique, personal goals forms the foundation of any strong financial plan.

A financial plan must reflect the stage of life its owner is in: whether purchasing a first home, financing a child’s college education or planning for retirement. A plan must reflect its owner’s personal or business situation, and highlight those financial products that best fit it. A custom-tailored financial plan must also be continually reviewed to measure its achievements against stated aims, and ensure the owner is comfortable everything is moving forward according to plan.

If you ever have questions about your plan or about specific financial products, contact us. We will set up a time to meet to review your needs and address any questions you may have.

Newsletters

-

Key Retirement and Tax Numbers for 2024

This article presents the IRS’ cost-of-living adjustments for 2024 that affect contribution limits for retirement plans and various tax deduction, exclusion, exemption, and threshold amounts.

-

HOT TOPIC: A Cautiously Optimistic Economic Outlook for 2024

The U.S. economy grew in the third quarter of 2023, despite high interest rates and unsettling geopolitical conflict. This article discusses market conditions and economic forecasts for 2024.

-

Market Measures: Beyond the Dow

In addition to the better-known Dow Jones Industrial Average and S&P 500 stock indexes, this article provides an overview of some stock indexes that are commonly used as benchmarks.

-

Insurance Gaps May Pose Risks for High-Net-Worth Households

It’s important for affluent families to reassess their liability coverage periodically, to make sure it’s sufficient based on their finances, lifestyles, and the related risks.

Calculators

-

College Funding

Use this calculator to estimate the cost of your child’s education, based on the variables you input.

-

LTCI Cost of Waiting

Estimate the potential cost of waiting to purchase a long-term care insurance policy.

-

Net Worth

A balance sheet summarizes your assets and liabilities and reveals your net worth.